The march of technology has relentlessly propelled the financial sector into an age of digital transformation. Central to this metamorphosis has been the adoption of cloud services, offering financial institutions scalability, agility, and cost efficiencies. However, with new opportunities come new challenges. As the cloud becomes an integral part of financial ecosystems, ensuring a safe, compliant, and efficient exit from cloud services becomes paramount. Recognizing this, the European Banking Authority (EBA) has delineated specific recommendations for financial institutions. Let’s delve deeper into these guidelines and understand the implications for the financial sector.

Understanding the EBA’s Stance on Cloud Services

The European Banking Authority, cognizant of the rapid adoption of cloud services by financial entities, has formulated recommendations to ensure that risks associated with the cloud are appropriately managed. These guidelines aren’t just about risk mitigation; they emphasize the importance of governance, transparency, and operational resilience.

A cornerstone of these recommendations is the need for a robust cloud exit strategy. The EBA understands that while moving to the cloud is a strategic decision, being able to move away from it – for whatever reason – is equally strategic. This exit should not compromise data integrity, security, or the institution’s ability to continually provide core services.

Key Aspects of the EBA’s Recommendations

Governance and Strategy: Institutions should incorporate cloud service considerations within their internal governance and risk management frameworks. This includes ensuring that top management is involved in and informed about significant cloud activities and that there’s a clear strategy regarding the institution’s use of cloud services.

Risk Assessment and Management: Before entering into any agreement with cloud service providers, institutions should conduct thorough risk assessments. This involves understanding data sensitivity, potential impacts on operational resilience, and ensuring that risks are identified, managed, and monitored.

Transparency and Accountability: Financial institutions are urged to ensure transparency in their cloud engagements. This includes notifying competent authorities about any significant operational or security incidents related to cloud services.

Contractual Clarity: Contracts with cloud service providers should be clear and unambiguous, especially concerning the rights and obligations of both parties. This includes data ownership, access rights, and, importantly, terms related to the termination of services.

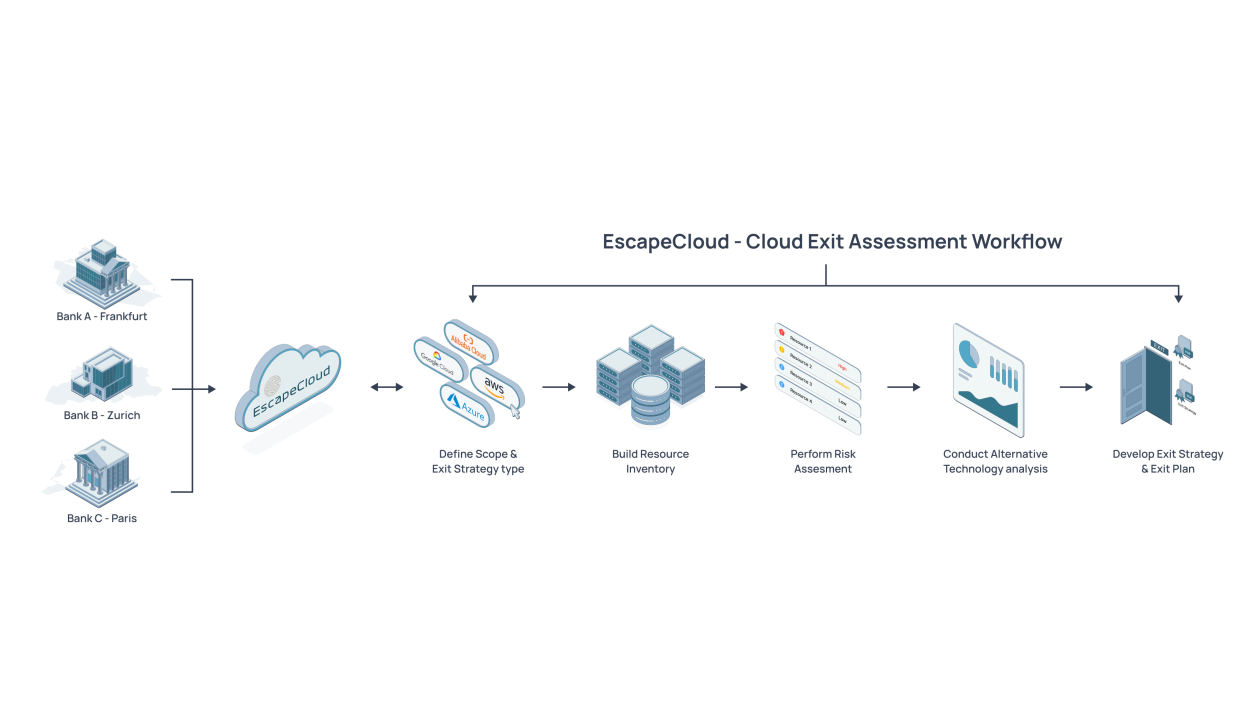

Exit Strategies: One of the most emphasized recommendations is that institutions must establish, implement, and regularly review a comprehensive cloud exit strategy. This strategy should ensure that the institution can transfer its data and functions from one cloud service provider to another or back to its own IT environment without any disruption.

Challenges for Financial Institutions

Implementing the EBA’s recommendations is not without challenges:

- Complexity of Migration: Transitioning away from a cloud provider often involves intricate data migrations, ensuring compatibility with new or legacy systems, and managing potential service disruptions.

- Operational Overheads: While the cloud offers operational efficiencies, transitioning away requires significant operational inputs, from manpower to time to technical resources.

- Cost Implications: There are often financial implications associated with a cloud exit, from penalties or costs associated with breaking contracts to expenses related to the migration itself.

- Compliance Assurance: With regulations continually evolving, ensuring ongoing compliance during and after a cloud exit can be daunting.

- Vendor Lock-in: Financial institutions might find themselves deeply integrated into a particular cloud provider’s ecosystem, making an exit strategy complex and challenging.

In Conclusion

The European Banking Authority’s recommendations provide a clear roadmap for financial institutions navigating the cloud landscape. However, the real-world implications of these guidelines mean that institutions need to be proactive, strategic, and informed in their approach to cloud services.

While the challenges are manifold, the stakes are too high to ignore the need for a robust cloud exit strategy. The coming weeks will explore how institutions can overcome these challenges and ensure that their cloud journey, both entering and exiting, is smooth, compliant, and aligned with their strategic objectives.